We offer a full range of Accounting, taxation and business support services to owner managed businesses, Individuals, small charities & other non-profit making organisations.

Tax-Free Childcare is a government scheme available to working parents, including the self-employed, with children aged 0 to 11. Eligible parents can get up to £2,000 per child per year towards qualifying childcare. For clients with 2 children, it could mean a £4,000 saving per year on the family’s budget. Parents can use it on…

The IR35 ‘off payroll’ rules are to be extended to the private sector from April 2020 onwards. The purpose of the legislation is to remove the tax advantages of providing services via a limited company for individuals who are not truly in business on their own account. Have a look at the following item: https://www.itcontracting.com/april-2020-private-sector-ir35-changes-what-happens-now/…

GUIDE TO INFORMATION REQUIRED IN RESPECT OF YOUR SELF ASSESSMENT TAX RETURN Details required if you are employed Form P60 (details of income and tax deducted during the year). Form P11d (details of benefits provided if P11d form is not available). Details of bonuses or other income whether taxed or not. Your PAYE coding notices,…

The number of spam emails and phishing scams generated are steadily increasing, with the tactics used by scammers becoming more sophisticated. We would strongly advise you to look at the articles from HMRC, Companies House and our own IT support company via the links below for more detailed information and advice. https://www.gov.uk/report-suspicious-emails-websites-phishing https://www.gov.uk/government/news/scam-emails-claiming-to-be-from-companies-house https://www.cortecit.co.uk/phishing/ https://www.cortecit.co.uk/spam-spoofed-emails/…

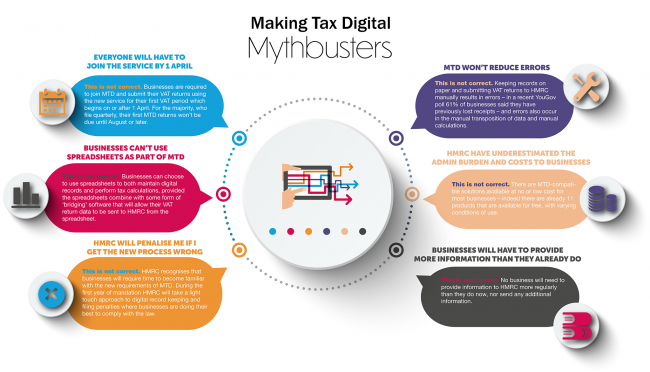

Making tax digital is a scheme by the UK government to make it easier for businesses and individuals to manage their taxes. The first stage comes into play on 1st April 2019 and is called Making Tax Digital for VAT. From this date, VAT registered businesses (those companies with their turnovers over the VAT threshold,…

With Making Tax Digital for VAT around the corner, we have decided to demystify some of the most common misconceptions surrounding MTD in our infographic below.