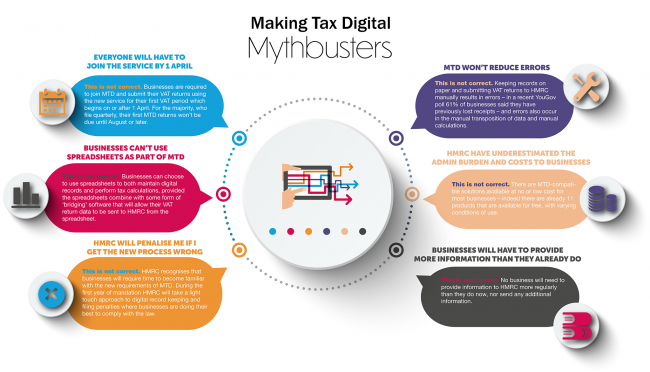

Making Tax Digital

Making tax digital is a scheme by the UK government to make it easier for businesses and individuals to manage their taxes. The first stage comes into play on 1st April 2019 and is called Making Tax Digital for VAT. From this date, VAT registered businesses (those companies with their turnovers over the VAT threshold,…